Latest News

Mark Lister, Investment Director at Craigs Investment Partners offers an economic update, with indications that 2025 will be prove to be an improvement on the last two years.

It’s been a very difficult couple of years for most New Zealand businesses. The economy has contracted for seven of the past eight quarters on a per capita basis (with the one other quarter being flat, rather than up).

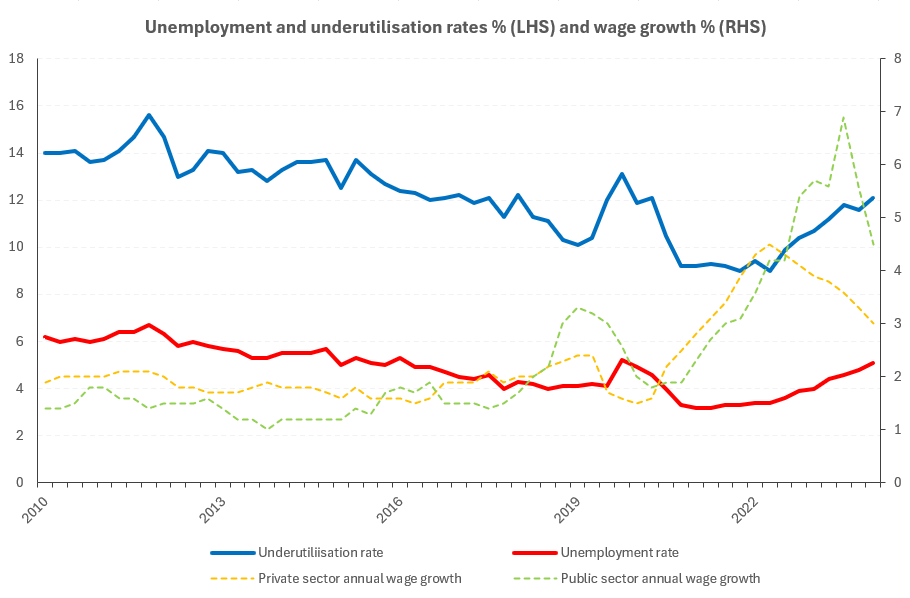

This challenging backdrop was highlighted by the labour force report last week, with the unemployment rate rising from 4.8 to 5.1 per cent in the December 2024 quarter. While in line with expectations, that’s the highest since the September 2020 quarter and it’s slightly above the 25-year average of 4.8 per cent.

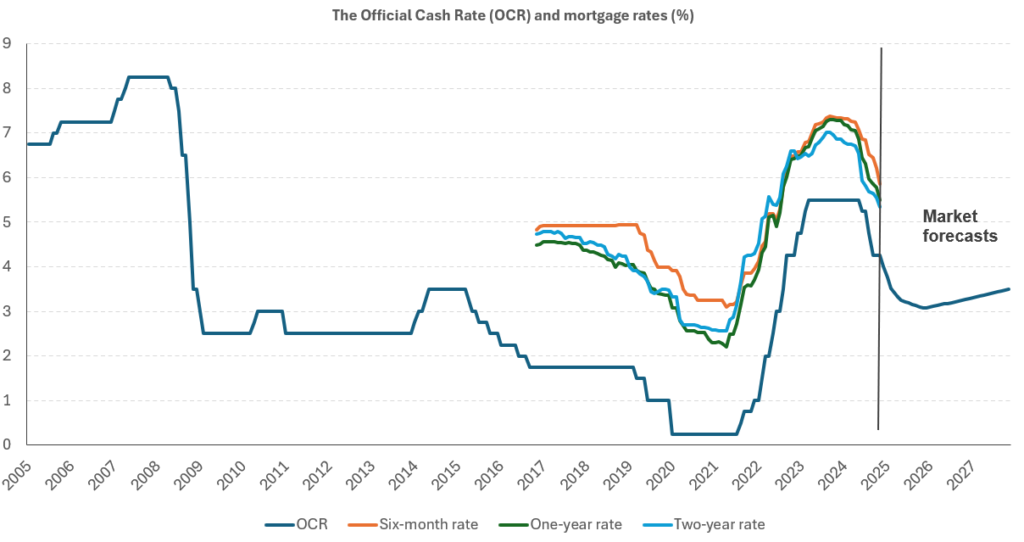

More encouragingly, the economy is likely to improve and 2025 should prove to be a much better year than the last, or the one before that. After increasing the Official Cash Rate (OCR) to 5.50 per cent in 2023, the highest since 2008, the Reserve Bank of New Zealand (RBNZ) reduced it three times over the second half of last year. That sees it at 4.25 per cent today, with another cut of 0.50 per cent expected this month.

Beyond that, markets expect the OCR to settle at around 3.00 per cent by the end of the year. The one-year mortgage rate has already fallen from a peak of 7.3 per cent a year ago to about 5.5 per cent today. While it will likely go a little lower, most of the decline is now behind us. This will take the pressure off households, increasing disposable incomes and boosting activity.

There is always a lag as interest rate changes flow through to the economy, typically as long as 18 months. Given the preference borrowers have had for shorter mortgage terms in recent times, we won’t have to wait nearly that long this cycle.

Confidence amongst businesses has bounced on the back of the OCR cuts, and firms are looking forward to a more buoyant period ahead. The Own Activity measure in the ANZ Business Outlook – typically a very useful leading indicator for where economic growth is headed – hit a ten-year high in December.

The RBNZ has been reducing interest rates more aggressively than many international peers and a byproduct of this has been a weaker currency. The NZ dollar is trading at around US$0.56 right now, the lowest since 2009 and some 15 per cent below the long-term average against the greenback of US$0.66. It’s also weakened (but to a lesser extent) against the Australian dollar and British pound over the past six months.

Currency weakness is a double-edged sword, because while it increases the competitiveness of exporters it also means that many imported goods (including fuel) become more expensive.

One sector that has benefitted more than most is the dairy industry. The Global Dairy Trade (GDT) index rose 18.9 per cent in 2024, and it’s pushed higher so far in 2025 with prices at two-and-a-half year highs. Dairy products are quoted in US dollars, so the lower currency has helped push prices even higher.

Fonterra has a milk price forecast range of $9.50 to $10.50, with a midpoint of $10.00. If that eventuates (or if it is exceeded) it would be the highest of all time and above the previous record of $9.30 from the 2021/22 season. This will deliver a strong growth impulse to many regional economies.

While this year is expected to be a much better one for the economy, there are no shortage of risks. One of the most obvious is the potential for policy uncertainty and geopolitical stresses offshore. US President Donald Trump has threatened to impose harsh tariffs on numerous countries since taking office, and while he has softened his stance in some cases, this could be a sign of things to come.

He is a pro-growth, business-friendly president that wants to reduce regulation and red tape, which bodes well for the US economy. However, he is also willing to accept short-term economic (and financial market) pain if he believes it will help deliver a better long-term outcome for America.

While New Zealand is not directly in the firing line, we will be impacted by any flow-on effects. China is our biggest export market, and we will not be immune to a further slowdown in the world’s second largest economy. In terms of goods exports, the US and Australia are a close tie for second, while Australia’s economic success is also closely linked to China.

As a small, open economy that relies on international trade, we must be mindful of our vulnerabilities in this regard.

The information in this article is provided for information only, is intended to be general in nature, and does not take into account your financial situation, objectives, goals, or risk tolerance. Before making any investment decision, Craigs Investment Partners recommends you contact an investment advisor.