Latest News

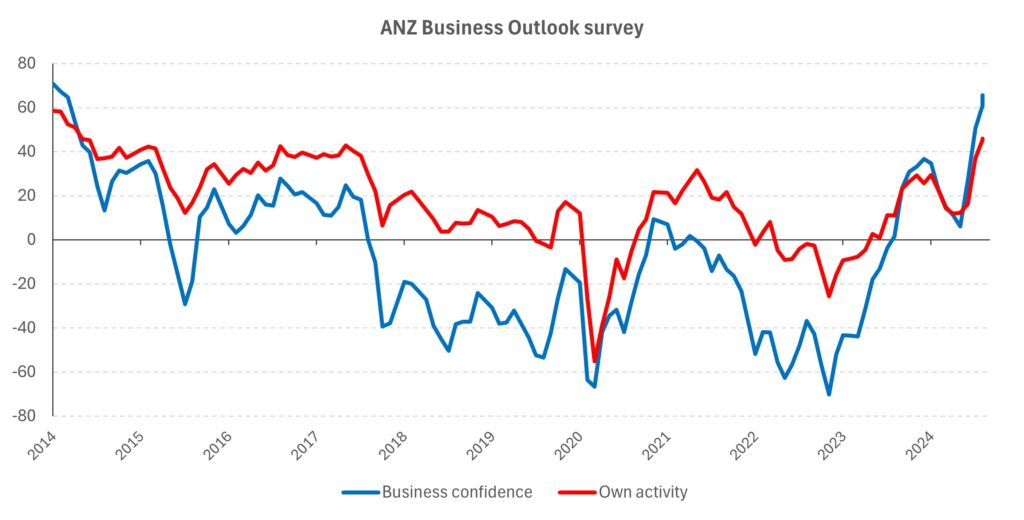

Graph above shows New Zealand business confidence is at a 10-year high, so businesses are clearly seeing brighter times ahead (even if things are still difficult right now)

Mark Lister, Investment Director at Craigs Investment Partners give us an economic update, which offers reasons for some optimism...

Another excellent year for investors

With only a matter of weeks to go, 2024 has been another very lucrative year for investors so far.

At the time of writing, world shares are up 20.8% (or 27.9% in NZ dollar terms), on the back of a 22.8% rise in 2023 (23.4% in NZ dollar terms). These gains are more than double the 20-year average of 8-10% per annum.

Pleasingly, the New Zealand markets has also turned a corner, with the NZX 50 index up 8.5% in 2024. While that’s a more modest gain than we’ve seen elsewhere, it makes for the best year in four and is in line with the 20-year average of 7.4% for the local market. Fixed income has also performed solidly, with the NZX Corporate Bond Index rising 5.1% so far in 2024. That comes on the back of a 7.5% gain last year (which was the strongest since 2014).

Inflation is down, and interest rates have followed

Inflation pressures continue to ease in most of the major regions. Here in New Zealand, the headline inflation rate has fallen to 2.2%, very close to the midpoint of the Reserve Bank target band.

It should be noted that much of the decline has been due to falling imported inflation, and that domestic price pressures remain more persistent. Nonetheless, the Official Cash Rate (OCR) has declined from 5.50% to 4.75% in recent months. Another 0.50% cut is expected at the end of November, and the OCR is likely to keep falling through 2025.

2025 should be a much better year for New Zealand

Lower interest rates should improve the backdrop for businesses and the economy, which has been in a per capita recession for close to two years, will return soon to growth.

There is always a lag as interest rate changes take effect and conditions could remain challenging over the next few months. This lag might be shorter than it has been in the past, with many borrowers having opted for shorter mortgage terms in recent years.

In the coming months, businesses should experience a moderation in cost pressures, increasing availability of labour, improving sentiment and a willingness from customers to spend on goods and services.

In October, house prices rose for the first time February. National values are up 2.7% from the May 2023 trough, but 15.9% below the 2021 peak. We should see an improvement across the housing market in 2025, which will be important for consumer sentiment more broadly. However, low affordability and other challenges are likely to mean price increases are modest, rather than substantial.

An element of caution is still required

There are many reasons to be optimistic, but an element of caution is required.

We can’t completely rule out a slowdown or recession in some of the world’s major economies over the coming 18 months, even though economic indicators remain robust. We must also monitor policy changes in the wake of the recent US election, as well as ongoing geopolitical tension across the world.

President-elect Donald Trump is a pro-growth, business-friendly candidate who will look to reduce regulation and lower taxes. However, New Zealand will need to keep a close eye on tariffs or increasing global trade tensions. We are a small trading nation that is highly dependent on exports, and China and the US are two of our biggest markets.

Mark Lister is Investment Director at Craigs Investment Partners. The information in this article is provided for information only, is intended to be general in nature, and does not take into account your financial situation, objectives, goals, or risk tolerance. Before making any investment decision, Craigs Investment Partners recommends you contact an investment advisor.